Dealers & Traders

- What our clients Say About Us

- Dealers

Safeguarding Your Philately Business

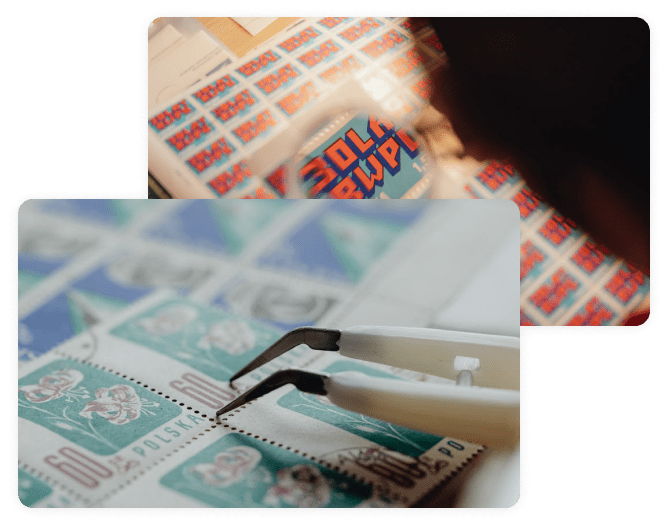

Stamp dealers, also known as philatelic dealers, play a crucial role in the world of philately by facilitating the exchange of stamps among collectors and philatelists. Stamp dealers vary in size and specialisation, and they offer a wide range of services to the trade, collectors and enthusiasts.

Protection Against Unforeseen Events

Accidents happen. Whether it’s a fire or flood, theft, burst pipe, accidental damage or loss or damage in transit, the unforeseen can have a catastrophic impact on your business.

Arranging specialist insurance cover ensures that your business will have the financial resources to recover and to be able to continue offering valuable services to the philatelic sector. Without insurance, your ability to continue trading is at risk.

- Get Insurance

Get your Personalised Insurance Today!

Experience the peace of mind that comes with a personalised insurance plan crafted just for you.

Contact us today to start protecting what matters most.

Customized Coverage

Tailor your insurance to match the unique needs and value of your stamp collection.

Comprehensive Protection

Safeguard your stamps from theft, damage, loss, and unforeseen disasters.

Expert Appraisal Assistance

Benefit from our appraisal services to ensure your stamps are adequately insured.

- More From Us

Stamp and coin Collection Insurance

Safeguarding Your Philately Business

Magnet Insurance offers a tailored insurance policy to ensure financial protection against the multitude of risks faced by Philatelic Traders.

Our policy offers a range of cover options that can be tailored to meet your specific business needs, including:

- Property damage for stock, business contents and equipment, buildings

- Glass

- Business interruption

- Book debts

- Goods in transit

- Money & personal assault

- Employers liability

- Public liability

Glass

Providing protection for:

- Breakage of or damage to fixed plain plate or sheet or wired glass in doors and windows

- Resultant damage to framework

- Boarding up costs

- Fixed mirrors, fixed glass in show cases, counters and display cabinets

- Fixed external signs

- Display contents up to £1,000

- The cost of repair of alarm foil or other security devices up to £1,000.

Book Debts

- Providing protection for outstanding debit balances, owed by clients, which you are unable to identify following loss of or damage to books of account and other records by an insured peril. Cover is also provided for additional expenditure incurred in tracing the amounts owed.

Public Liability – £2m Limit of Indemnity

- Covers your legal liability for causing accidental bodily injury to the public or damage to their property as a result of negligence by you or your employees, anywhere in Great Britain, Northern Ireland, the Isle of Man or the Channel Islands and non-manual work elsewhere in the world

- Cover also extends to include other legal liabilities such as interference with or loss of enjoyment of property as a result of obstruction, trespass or nuisance; non owned motor contingent liability; cross liabilities; leased, hired or rented premises; those incurred under the Defective Premises Act 1972

- Covers legal costs incurred in the defence of criminal proceedings in respect of a breach of the Health and Safety at Work etc Act 1974 limited to £10,000 in any one period of insurance

Property Damage

Our policy covers loss, destruction or damage occurring at the insured location/s cased by fire, lightning, explosion, impact from aircraft and other vehicles, theft or attempted theft, riot, civil commotion, malicious damage, earthquake, storm, flood and burst pipes.

Automatically covered is:

- Stock and equipment whilst at any fair, exhibition or at any hotel you attend anywhere in the UK

- Accidental damage to stock and equipment at your premises

Business Interruption

- This section affords protection against financial loss during the period taken for the business to return to normal following loss or damage by any of the perils insured under the Property Damage section. Reasonable costs incurred to maintain the business following loss or damage are included.

Goods in Transit

- Provides protection for your goods against loss or damage whilst in transit by your vehicles or other carriers, including whilst loading and unloading

Money & Personal Assault

- Providing protection for loss of money whilst in transit or in a bank night safe, during business hours whilst on the premises, outside business hours whilst on the premises, at your home or the home of an authorised employee and in the custody of an approved security company or organisation

- Principals and employees are automatically covered as part of the Money section for financial compensation if they sustain bodily injury or death following an assault whilst handling money on your business

Employers Liability – £10m Limit of Indemnity

- Complies with U.K. current legislation relating to compulsory insurance for legal liability for damages arising from injury to employees or volunteers in connection with your business

- Automatically legal costs incurred in the defence of criminal proceedings in respect of a breach of the Health and Safety at Work etc Act 1974 limited to £10,000 in any one period of insurance

Summary of Cover

Download a PDF with more information about cover details.

Stamp dealers serve as a valuable resource for collectors, providing access to a wide range of stamps, offering expertise, and helping collectors build and enhance their collections.

Knowing that your business assets and importantly your business liability risks are insured, offers peace of mind and financial protection.

Important

To obtain the full benefit from your insurance it is important that the sums insured are adequate at all times. If they are inadequate then in the event of a claim the amount payable will be reduced in proportion to the degree of underinsurance. The Property Damage section of the policy is index linked to provide a measure of protection against the effects of inflation. This benefit does not apply to other sections of cover.

It makes sense to review the sums insured regularly, particularly if you have refurbished your premises, purchased new equipment or increased stock levels or staff. Seek professional advice to ensure that the sums insured are correct.

- FAQ's

Frequently Asked Questions

Have questions about Magnet Insurance and our services? Find answers to common queries below.

If you can’t find the information you’re looking for, feel free to reach out to our customer support team for help.

Magnet Insurance offers a wide range of insurance products, including home and property insurance, specialty insurance for a wide range of hobby collections, including stamps, coins, medals, postcards, model railway and many more.

We like to think we experts in the field of insurance and will always go the extra mile to find the most suitable solution. We are proud of our excellent review scores and our staff our approachable, friendly and knowledgeable and will always treat you with respect and answer phones quickly!

Yes, just drop us an email or phone us with full details and 9 times out of 10 we can amend your current policy to reflect any changes to risk details of coverage.

We will issue your renewal invitation either by email or post, about 3 weeks before your policy expiry date. This will contain details of how to renew your policy.